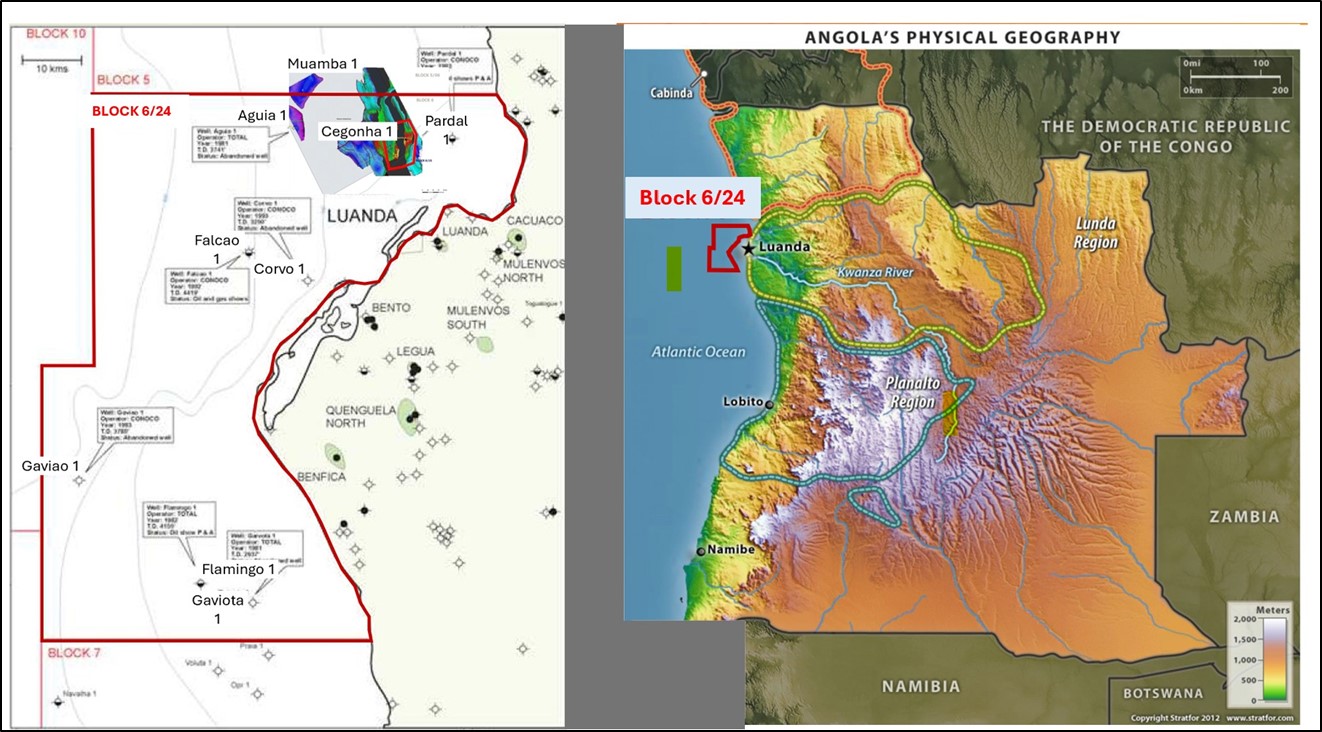

Figure 1: Block 6/24 Location

Highlights

- Red Sky awarded a 35% interest in Block 6/24 offshore Angola in the Kwanza Basin in December 2024

- Block 6/24 has an aerial size of 4,930km2 and is covered by 1,531km2 of 2D seismic and 1,465km2 of 3D seismic

- Following Red Sky’s assessment of the materials contained in the data room for Block 6/24, the Company estimates that there is significant potential for oil to be found in Block 6/24

- The Company’s review and analysis of all data available also indicates that 9 wells have been drilled in Block 6/24, with one of the wells discovering the Cegonha oil field

- Preliminary assessments indicate a potential commercial discovery

- Geological and Geophysical studies are now being initiated to firm up the resources of this discovery

- Block 6/24 is located in an area with several oil discoveries and high prospectivity

Block 6/24 Ownership and Location

- The Angolan National Agency for Oil, Gas and Biofuels (ANPG) and Red Sky signed a Risk Service Contract (RSC) on 31 December 2024 for offshore Block 6/24 in partnership with ACREP Exploração Petrolífera SA (ACREP) and Sonangol Exploracao e Produção SA (Sonangol E&P). The RSC for offshore Block 6/24 is the result of direct negotiations undertaken by Red Sky with ANPG.

- Sonangol E&P is the operator of the Block with a 50% participating interest. Red Sky Energy will hold a 35% participating interest, and ACREP will hold the remaining 15% participating interest.

- Block 6/24 is located 12 kilometres offshore Angola in the Kwanza Basin, in water depths ranging from 70 to 80 metres. The Block is covered by 1,531km2 of 2D seismic and 1,465km2 of 3D seismic.

- Red Sky was granted access to a data room by the Angolan National Agency for Oil, Gas and Biofuels (ANPG) during the direct negotiation process. As a result of its review of the materials in that data room, the Company estimates that there is significant potential for oil to be found in Block 6/24. In addition, the Block contains the Cegonha oil discovery, and further studies are to be undertaken to determine the commerciality of that discovery.

Angola Context

In recent years, Angola has made significant strides to create a more favourable environment for foreign investment, particularly in the oil and gas sector. The country has implemented regulatory reforms to streamline the process for foreign investors, making it easier to do business in the country. This includes the establishment of the Angolan National Agency for Oil, Gas and Biofuels (ANPG) to oversee the oil and gas sector.

Angola is investing in infrastructure development, which supports the operations of foreign companies, particularly in the oil and gas industry. It has also been actively seeking and establishing strategic partnerships with foreign companies to further develop its natural resources and maximise their value.

Relative stability, in conjunction with security and an attractive exploration and production landscape, provides the country with the edge over regional peers. While challenges remain, Angola is generally considered friendly to foreign investment, particularly in sectors like oil and gas, where it seeks to leverage foreign expertise and capital to develop its resources.

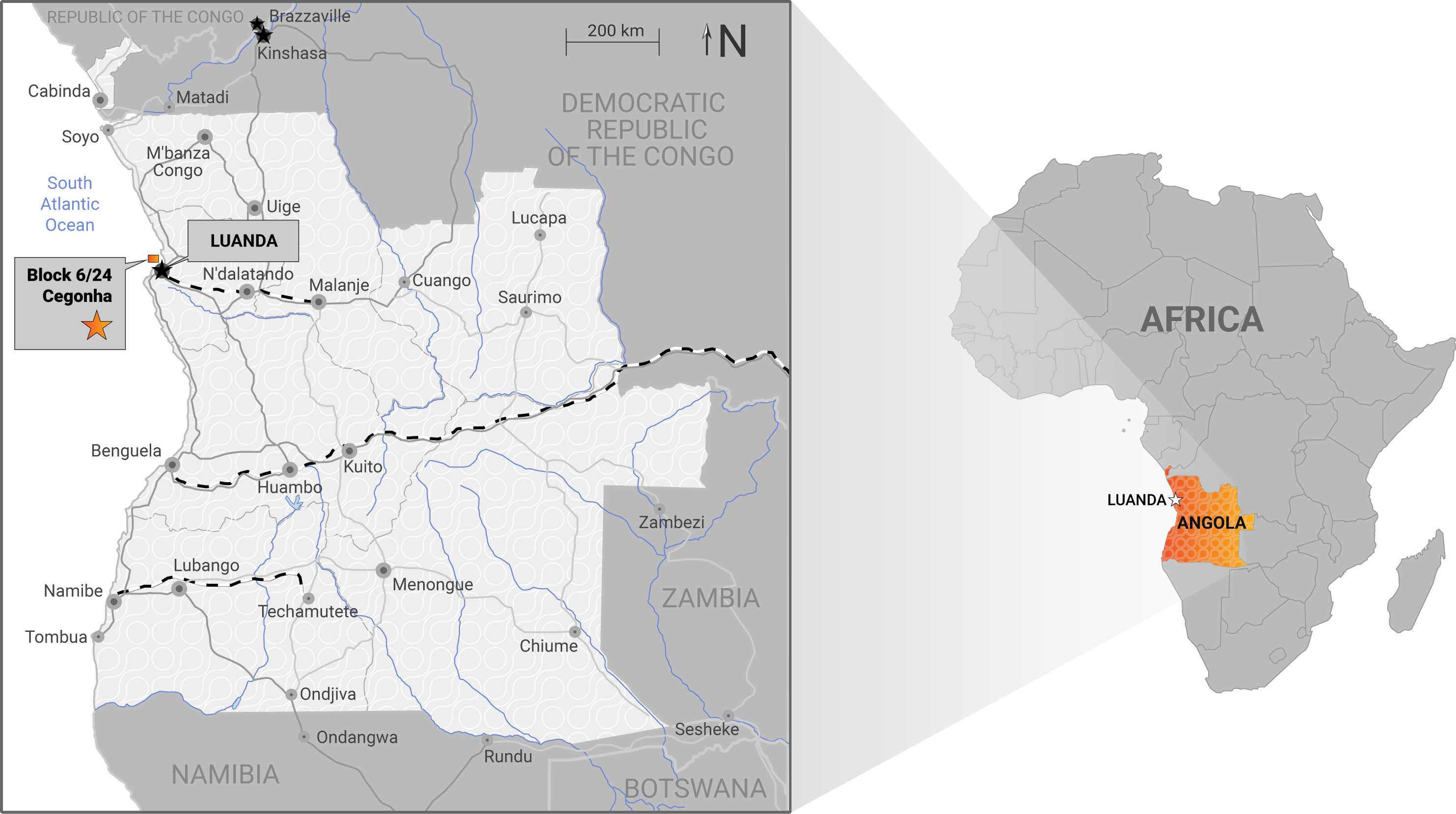

Figure 2: Angola location map with the approximate location of Block 6/24

Risk Service Contract

The Risk Service Contract (RSC) entered into by Red Sky is an agreement typically used in the oil and gas industry where one or more companies (the contractors) agree to explore, develop, and produce hydrocarbons in a specific area on behalf of the host government or national oil company. The key features of the RSC include:

Assumption of Operational and Financial Risk: The contractor parties (Red Sky, ACREP, and Sonangol E&P) assume all financial and operational risks associated with the undertaking of exploration, development, and production activities within the Block.

Cost Recovery: The contractors are entitled to recover their exploration and development costs from the production revenues generated from the sale of hydrocarbons produced from Block 6/24.

Profit Share: In addition to cost recovery, the contractors earn a share of the profits generated from the sale of such hydrocarbons based on certain performance metrics set out in the RSC.

Ownership and Control: ANPG retains ownership of all hydrocarbons produced from Block 6/24. However, it is contractually required to make payments in kind to the contractors on account of their cost recovery and profit share entitlements when such hydrocarbons are sold. Sonangol E&P, as the operator appointed under the RSC, is afforded exclusive operational control of all exploration and production activities undertaken in Block 6/24.

Duration: The RSC has an initial 6-year exploration and appraisal period, and if no commercial discovery is made or declared, the RSC expires at the end of this period. If a commercial discovery is made or declared, then the RSC remains in force and effect for a further 30 years in respect of the applicable development area.

Minimum Work Obligations: The RSC requires that the contractors undertake geological and geophysical studies and seismic data reprocessing during the first 3 years of the initial research period, and if they elect to enter the 4th year, they are then obliged to drill an exploration or appraisal well, If however they do not elect to enter the 4th year, then they are taken to have withdrawn from the RSC without penalty.